Student Loan Forgiveness, Black Debt, and the M.Div Degree

Dr. Aaron Treadwell, Contributing Writer

On August 24, 2022, President Joe Biden announced a three-part student loan relief program in an attempt to “target debt relief as part of a comprehensive effort to address the burden of growing college costs and make the student loan system more manageable for working families.”[1] This program is targeted towards persons with an income of less than $125,000 and less than $250,000 for married couples. The majority of African Methodist Episcopal (AME) clergy fall within this financial window, and those with student debt will likely be utilizing this program. And yet, the question remains if this is enough to save AME clergy from insurmountable debt.

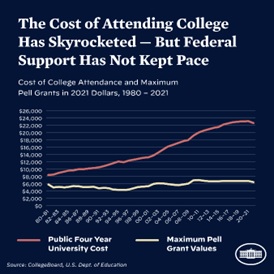

Currently, the AME licentiate is in a precarious situation during this recession; and that issue is that our denomination requires an M.Div degree that has recently netted a negative deficit. The average cost of an MDiv program is $14,000 (yearly) on the low end, while some programs like Vanderbilt, Emory, and Duke are over $30,000 a year. According to the White House, the cost of attending college has ‘skyrocketed’ while federal support has not kept pace. This is not an oversight for the Episcopal committee of the Denomination, but the negative impact of school debt has now become a major national issue.

So, where do we go from here? A brief personal survey on student loans has witnessed an average of $30,000 in debt from an MDiv degree.

Some of the interviewed populations were in denominations that covered all tuition (United Methodist Church (UMC), Lutheran, Catholic, Presbyterian). When looking at the curve, those clergy who had to “foot the bill of divinity school” are closer to high five-to-six-figure debts than the $30,000 amount.

During reconstruction, Rev. Henry McNeal Turner (prior to his Episcopacy) demanded 100 million dollars (3.3 billion in 2022) in federal reparations to send African Americans back to Africa. His reasoning was clear, “we cannot exist here, and if no reformation is possible in this country, rather than be exterminated by mobs and lynching assassins, we had better ask Congress, or the Nation, for at least a hundred million of dollars to leave this country.”[2] The plight of black people throughout the diaspora is not in the same situation as during the Nadir Era of race relations (1877-1905), but the financial strains of debt can be debilitating. Student loans block persons from generating income and building net worth, including but not limited to purchasing a home. It is no coincidence that the demographic groups with the most student loans (blacks owe $25,000 more on average than whites) and the lowest percentage of home ownership (black ownership is 30% lower than white Americans) are African American.[3]

So, is the issue all on the federal government, or is there also a responsibility for AMEs and other African American churches to change their policies to offset student debt? Our denomination, like the UMC, has home-grown seminaries, whereas our schools have not been able to cover the full tuition compared to the aforementioned denominations. In addition, maybe a policy that requires a master of divinity for all charges requires a second look. Taking a page from the White House, sometimes desperate times, calls for desperate measures. If the highest position in the United States is calling for educational and financial reform, maybe our Zion should follow suite.

[1] House, The. 2022. “FACT SHEET: President Biden Announces Student Loan Relief For Borrowers Who Need It Most – The White Hous.”. The White House. https://www.whitehouse.gov/briefing-room/statements-releases/2022/08/24/fact-sheet-president-biden-announces-student-loan-relief-for-borrowers-who-need-it-most/.

[2] The Christian Recorder, October 19, 1893.

[3] “Student Loan Debt By Race [2022]: Analysis Of Statistics”. 2022. Education Data Initiative. https://educationdata.org/student-loan-debt-by-race#:~:text=Black%20and%20African%20American%20student,payments%20of%20%24350%20or%20more.